Most people think of crypto mining simply as a way of creating new coins. Crypto mining, however, also involves validating cryptocurrency transactions on a blockchain network and adding them to a distributed ledger. Most importantly, crypto mining prevents the double-spending of digital currency on a distributed network.

Like physical currencies, when one member spends cryptocurrency, the digital ledger must be updated by debiting one account and crediting the other. However, the challenge of a digital currency is that digital platforms are easily manipulated. Bitcoin’s distributed ledger, therefore, only allows verified miners to update transactions on the digital ledger. This gives miners the extra responsibility of securing the network from double-spending.

Meanwhile, new coins are generated to reward miners for their work in securing the network. Since distributed ledgers lack a centralized authority, the mining process is crucial for validating transactions. Miners are, therefore, incentivized to secure the network by participating in the transaction validation process that increases their chances of winning newly minted coins.

In order to ensure that only verified crypto miners can mine and validate transactions, a proof-of-work (PoW) consensus protocol has been put into place. PoW also secures the network from any external attacks.

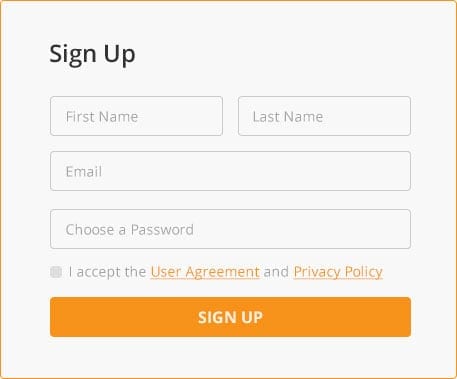

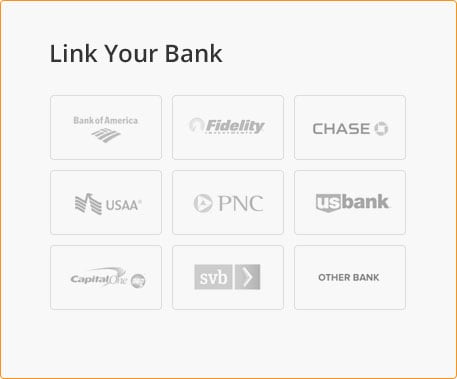

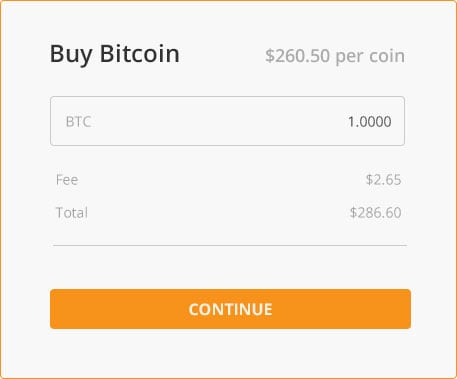

To start trading cryptocurrencies, you need to choose a reputable crypto exchange like Finteria trading platform. Once you have an account, you can deposit funds and start trading. You can choose to buy and hold a cryptocurrency for a long-term investment, or you can actively trade it by buying and selling frequently.

There are many different types of cryptocurrencies available for trading, including Bitcoin, Ethereum, Litecoin, and more. Each cryptocurrency has its own unique features and benefits, so it’s important to do your research before investing.